January 2024 Insights

AW constantly monitors the investment markets and aims to keep our valued clients regularly informed and updated. We aim to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

In this edition we cover:

2023 Market Returns

Investment Themes to Watch

The Year of Elections

2022 VS 2023 Market Returns

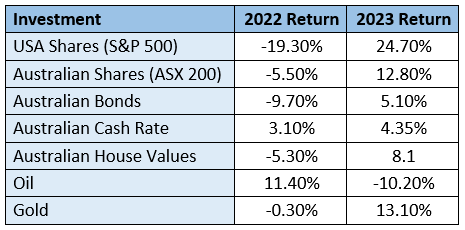

The table below shows the returns comparing calendar year 2022 to 2023. The good news was spread across all major asset classes in the 2023 year.

Markets rallied in December to finish the year off strongly. Whilst last year we faced fears of rising inflation and rising interest rates leading to expectations of a recession, the markets are now eyeing the prospects moderating inflation, falling rates and moderate growth. The S&P500 has recovered back close to its’ all-time record highs.

We still face a scenario that inflation around the world remains higher for longer which may put the “Soft Landing” outcome at risk. If this occurs, shares could experience a pullback.

Investment Themes to Watch

Ongoing themes for investors are likely to include:

The rapid development of AI and other transformative technologies

Innovations in healthcare and pharmaceuticals

Renewable energy to support global emission targets

Lithium and other components in batteries to power EV’s

Increased awareness of the need for cybersecurity technology

If the last few years have taught us anything, it’s to expect the unexpected. One thing we can predict with some certainty is that market volatility and uncertainty are likely to persist in 2024, and that investors with a diversified portfolio tailored to their needs, who maintain a long-term focus and stay the course, are likely to weather whatever conditions come their way.

The Year of Elections (Biggest in History)

In 2024, we will see more than 70 elections in countries covering 4.2 billion people (approximately 50% of the world’s population). While many of these elections will be routine, we have seen the rise of fringe parties cause upsets or instability in power, and therefore some of the elections will have an effect on investment markets.

Here are the major elections to watch this year:

Taiwan: The incumbent Democratic Progressive Party was re-elected last week defeating the pro Chinese opposition Kuomintang party. China has already voiced its displeasure at the US congratulating the elected President and the world awaits for more retaliatory actions from Beijing.

India: In the spring of 2014, Bharatiya Janata Party (BJP) leader Narendra Modi was sworn in as India’s 14th prime minister. A decade later, he appears poised to win a third straight term in office in what will be history’s largest-ever democratic exercise: 900 million people voters will choose their next government.

Mexico: They are gearing up for its’ largest-ever election on June 2 that could see it elect a woman as its president for the first time. Mexico has a population of about 129 million and approximately 96 million registered voters.

USA: On November 5, the USA will vote for its’ president, all seats in the House of Representatives and a third of the seats in the Senate. The presidential race this year seems to be reminiscent of 2020, where Democrat Joe Biden, who is the current president, faced off against Republican Donald Trump, whom he defeated four years ago.

Indonesia and Pakistan: The world’s fourth and fifth-most populous countries, respectively, will hold general elections in February with Jakarta looking for a new leader as President Joko Widodo is ineligible for a third term, while Islamabad hopes to emerge from a constitutional crisis that led to the ouster and imprisonment of former Prime Minister Imran Khan.

FYI: Australia does not hold a Federal election until May 2025.

Any advice contained in this insight/update is general advice only and does not take into consideration the reader’s personal circumstances. To avoid making a decision not appropriate to you, the content should not be relied upon or act as a substitute for receiving financial advice suitable to your circumstances. When considering a financial product please consider the Product Disclosure Statement. Aspirations Wealth Group is a Corporate Authorised Representative of Aspirations Private Wealth Pty Limited. ABN 57 622 182 076 – AFSL 503889.