February 2024 Insights

AW constantly monitors the investment markets and aims to keep our valued clients regularly informed and updated. We aim to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

In this edition we cover:

Interest rates cuts for 2024?

The pitfalls of term deposits!

What will happen to share markets if Trump wins USA election?

Interest rates cuts for 2024?

It’s likely that 2024 will mark the commencement of interest rate reductions across most parts of the world. Inflation is moving back towards the target and unemployment is showing signs of easing. We believe that it is now the right time for diversified investors to plan their portfolios for a declining interest rate cycle.

For context, in the United States, the markets have factored in an approximate 1.5% reduction in interest rates over a span of a few years, with Australia anticipating about half of that. This poses a challenge for investors holding substantial amounts in cash or term deposits. On a positive note, interest rate cuts are expected to benefit the economy, influencing both the stock market and providing favourable conditions for bond investors.

The pitfalls of term deposits!

Consider two couples with a $1 Million nest egg each at the start of retirement. Their goal is to sustain an annual income of $50,000 throughout a 30-year retirement.

Option 1: Investing in a term deposit, with the bank offering a 5% term deposit for a 1-year term, anticipating a decline in rates in the coming years. This choice ensures a steady $50,000 income with no market volatility.

Option 2: A diversified, 75% growth portfolio, comprising of both bonds and shares, with the objective of achieving a 7% long-term return after factoring in costs.

Option 2 is the winner and superior choice! With its’ strategic approach, it emerges as the key to a truly great retirement, providing not only flexibility and enhanced outcomes but also the potential for leaving an inheritance for the next generation.

What will happen to share markets if trump wins USA election?

Investors are already planning out for the potential impacts of the upcoming 2024 USA presidential election, scheduled for November, on the share markets.

The competition between former President Donald Trump and Democratic President Joe Biden is anticipated to be closely contested, likely hinging on narrow margins in key battleground states.

Both ageing candidates, however, come with their challenges. Notable policy distinctions exist, particularly in key areas:

Taxes: Biden aims to increase taxes on wealthy individuals and certain corporations, framing it as an effort to introduce fairness to the tax code. In contrast, Trump is positioned to maintain or deepen tax cuts, viewing them as catalysts for economic growth.

Trade: While Biden’s campaign has not explicitly outlined a second-term trade policy, his administration has taken an assertive stance against some adversarial countries, such as China, while securing trade deals with others. Trump, on the other hand, intends to intensify the confrontational trade policy from his initial term, proposing to impose tariffs on a majority of imported goods.

Jobs: Trump’s campaign portrays its tariff policy as a safeguard for U.S. businesses, fostering a robust job market and reinforcing the domestic supply chain. In contrast, the Biden administration has implemented federal legislation designed to attract investment to U.S. companies, consequently increasing the demand for workers.

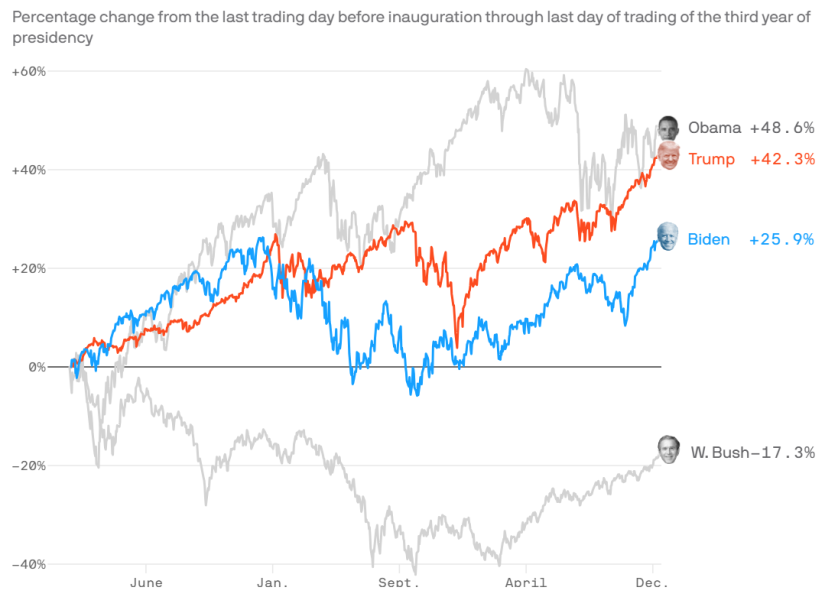

The chart below shows the returns from the USA share market (S&P500) over the past 4 presidents.

Aspirations Wealth remains undeterred by external distractions and noise, instead we choose to stay focused on the primary objectives. We firmly believe factors such as the Federal Reserve interest rate policy, the economic cycle and corporate earnings will ultimately hold greater significance in shaping the share markets.

Any advice contained in this insight/update is general advice only and does not take into consideration the reader’s personal circumstances. To avoid making a decision not appropriate to you, the content should not be relied upon or act as a substitute for receiving financial advice suitable to your circumstances. When considering a financial product please consider the Product Disclosure Statement. Aspirations Wealth Group is a Corporate Authorised Representative of Aspirations Private Wealth Pty Limited. ABN 57 622 182 076 – AFSL 503889.